Water well tax - peculiarities of source design and

Very often the well is used by organizations and individual entrepreneurs for commercial purposes. The law stipulates that all such sources must be formalized, in addition, you must have official permission to use natural resources. Depending on the volume and purpose of use, the amount of tax is calculated, it is paid quarterly.

How to fill out documents to the source

If you think that it is enough just to come to the tax authorities and pay a tax on a well, then this is far from being the case. Water intake must meet a variety of requirements and have all the necessary documents. Consider how to carry out all the work and make the necessary paper correctly.

Conditions under which drilling is permitted

Any source used by an organization for commercial purposes must meet a variety of requirements that you must verify yourself:

- On the adjacent territory should not pass any types of pipelines.

- There should not be any sources of biological pollution around the place of penetration of a well at a distance of 200 meters, these include landfills, drains and other similar objects.

- At a distance of at least 300 meters there should be no objects that carry the risk of chemical pollution. These include all types of hazardous industries, industrial workshops and enterprises, as well as car washes, gas stations and other similar facilities.

- Near the place of the proposed water intake should not grow trees, shrubs and other large vegetation.

- Depending on the characteristics of your site, the distance to the nearest buildings should be from 30 to 60 meters.

- If the device requires multiple water intakes, you should consult with experts about what should be the minimum distance between the sources. As a rule, it is 500 meters or more.

Nuances of registration

If all the conditions correspond to the above items, you can submit an application to the Federal Service, the specialists of which once again check all the points on their own, and, if all is well, will issue a conclusion about the quality of groundwater and the possibility to organize a sanitary zone on the site.

After receiving the conclusion, it is necessary to carry out the whole complex of design and settlement works:

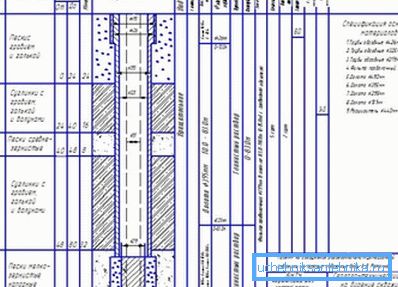

- A well project is being developed, after which it must be approved by government agencies.

- Calculation work is carried out to calculate the ratio of water consumption and drainage.

A package of documentation is sent to the subsoil use department, which issues a special license for an artesian well. Only after that you can begin drilling.

After all the activities and improvement of water intake, you must register it in the water cadastre. And, finally, the last one gets a passport to the well, into which the results of the water survey and various geophysical measurements are entered.

The price of all the above activities is significant enough, so be prepared for substantial costs.

Tip! Paperwork involves numerous trips to the authorities, a lot of paper work and a huge investment of time. Therefore, in order not to be distracted from the main work and not to redo the documentation several times, it is better to entrust this process to a special organization.

Features of tax payment

We note immediately that the payment amount is calculated by the payer himself, and government agencies can check whether the tax on an artesian well is calculated correctly.

The amount of tax is determined every quarter, depending on the tax base and the corresponding tax rate for the period for which the payment is made.

If you use several forms of water use, for example, commercial use of water, use of workers for drinking, etc., then the amount of payment is determined by summing all types of water use.

Note! In one well, water can be used for different needs. The amount of tax is calculated in accordance with each of the tax rates at which water use is made.

In accordance with the Tax Code of the Russian Federation, namely, Article 333.13 p.3, tax payment for each quarter must be made no later than the 20th day of the month following the reporting period.

Payment is made at the location of the organization or individual entrepreneur. The basis for determining the exact amount of tax is the Water Tax Declaration.

Her sample can be downloaded on the Internet or purchased at the tax office. In the same place there is also an instruction on the correct filling of the form.

Conclusion

In fact, there is nothing difficult in paying tax for using water. The main thing is that all necessary documents for the source should be drawn up without violation (find out here what the water level in the well should be).

The video in this article will help to better understand some of the nuances of paying water tax.